Incorporating monthly dividends into your family’s financial planning can significantly enhance your financial stability and growth potential. Monthly dividends provide a steady income stream, offering more frequent opportunities to reinvest and grow your wealth compared to quarterly or annual dividends.

This regular income can help manage monthly expenses, reduce financial stress, and create a disciplined savings habit. By investing in monthly dividend stocks, you can create a reliable source of income that supports your family’s financial goals, whether it’s saving for education, planning for retirement, or building an emergency fund.

Understanding Monthly Dividend Stocks

Monthly dividend stocks are shares of companies that distribute profits to shareholders every month, rather than quarterly or annually. This approach provides a consistent cash flow, which can be especially beneficial for those relying on investment income for living expenses. These stocks are typically issued by real estate investment trusts (REITs), business development companies (BDCs), and some other financial institutions that aim to provide regular returns to investors.

The predictability and regularity of monthly dividends can make financial planning easier and more effective, offering a way to smooth out cash flow and avoid the lumpy income that comes from less frequent dividend payments.

Finding A Relevant List Of Monthly Dividend Stocks

To get started with monthly dividend stocks, it’s crucial to find a comprehensive and up-to-date list of companies that offer these dividends. Sure Dividend provides an excellent resource for this. Their list of monthly dividend stocks includes detailed information about each company, including yield, payout ratio, and dividend history.

This resource is invaluable for investors seeking reliable monthly income, as it helps identify the best options to fit your financial needs and risk tolerance. By consulting this list, you can make informed decisions about where to allocate your investments to maximize returns and achieve your financial goals.

Diversifying Your Portfolio With Monthly Dividends

Diversification is a key principle in financial planning, and monthly dividend stocks can play a crucial role in this strategy. By incorporating these stocks into your portfolio, you can balance higher-risk investments with more stable, income-generating assets.

This diversification not only provides a buffer against market volatility but also ensures that you have a consistent income stream. Combining monthly dividend stocks with other types of investments, such as ETF Schweiz, growth stocks, and bonds, can create a well-rounded portfolio that supports long-term financial health and stability for your family.

Reinvesting Monthly Dividends For Growth

One of the most powerful strategies for growing your wealth is to reinvest your monthly dividends. By using the dividends to purchase more shares, you can take advantage of compounding returns. Over time, this reinvestment strategy can significantly increase your investment’s value, as you earn returns not only on your original investment but also on the dividends that are continually reinvested.

This approach can accelerate your wealth-building efforts, helping you reach your financial goals faster. If you’re saving for a major expense, planning for retirement, or building an inheritance, reinvesting monthly dividends can be a cornerstone of your financial strategy.

Family Financial Planning: Essential Tips And Strategies

Family financial planning is paramount for ensuring financial stability and achieving long-term goals. It involves creating a comprehensive plan that addresses various aspects of financial management, from budgeting and saving to investing and retirement planning. We will go over some essential strategies to help you develop an effective family financial plan.

Budgeting For Success

Creating a budget is the cornerstone of any financial plan. Start by reviewing your current income and expenses, categorizing them into necessities (housing, utilities, groceries) and discretionary spending (entertainment, dining out). The 50/30/20 rule is a popular budgeting method: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This approach helps ensure that you are living within your means and setting aside funds for future needs.

Setting Financial Goals

Defining clear financial goals is vital for guiding your financial decisions. These goals should include short-term objectives, such as building an emergency fund, and long-term aspirations, like saving for retirement or funding your children’s education. Prioritize these goals based on their urgency and importance. An emergency fund should be one of your top priorities, as it provides a financial safety net for unexpected expenses.

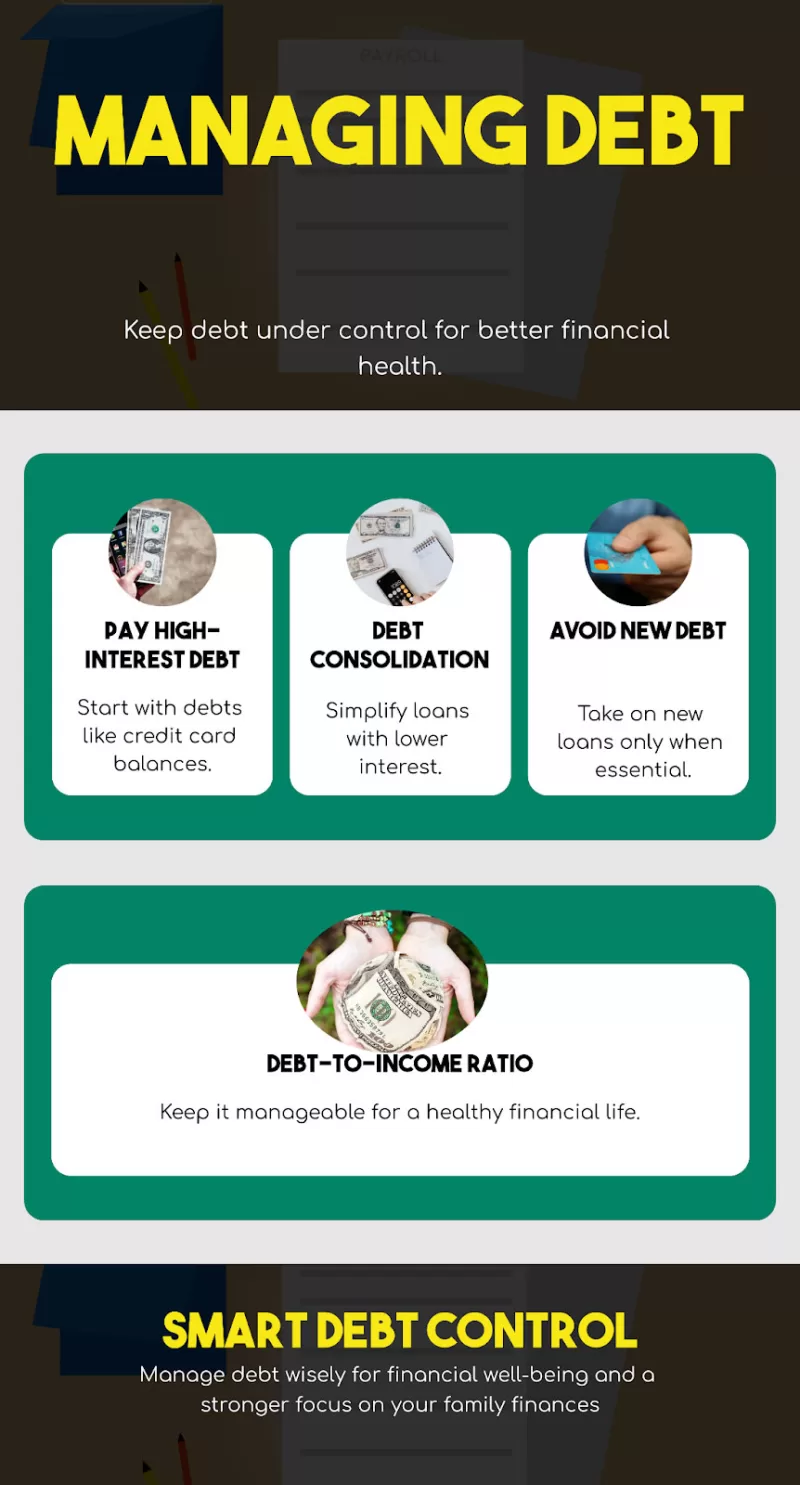

Managing Debt Wisely

Investing For The Future

Investing is a key component of building long-term wealth. Start by contributing to retirement accounts such as a 401(k) or IRA, taking advantage of any employer matching contributions. Consider exploring emerging sectors like AI, using tools such as AI penny stock tickers to identify potential opportunities. Regularly review and adjust your investments to ensure they align with your financial goals and risk tolerance.

estate planning

- Creating A Will: Clearly outline how you want your assets distributed after your death.

- Establishing Trusts: Set up trusts to manage and protect your assets, providing control over distribution and potential tax benefits.

- Designating Beneficiaries: Assign beneficiaries for your financial accounts to ensure assets go directly to them without going through probate.

- Appointing Power Of Attorney: Choose someone to make financial decisions on your behalf if you become incapacitated.

- Appointing A Healthcare Proxy: Designate a person to make healthcare decisions for you if you’re unable to do so.

- Minimizing Estate Taxes: Implement strategies to reduce estate taxes, preserving more of your wealth for your heirs.

- Avoiding Probate: Proper planning helps to avoid the lengthy and often costly probate process, ensuring a smooth transfer of assets.

Financial Education And Communication

Educating your family about financial management is crucial for long-term success. Engage in regular discussions about money, involving all family members in the planning process. Teach your children about budgeting, saving, and responsible spending from an early age. Open communication ensures that everyone understands the family’s financial goals and their role in achieving them.

Final Remarks

Including monthly dividends in your family’s financial planning, you not only gain a dependable income source but also enhance your ability to meet immediate financial needs while planning for future aspirations. This approach can significantly fortify your family’s financial foundation, ensuring stability and growth in the long term.

Leave a Reply